Table of Contents

Everyone Sells Experience

A few years ago, if you had asked me what “experience” meant in the IT industry, I would have given you a straightforward answer: it’s about how users interact with technology. A smooth UI, a fast-loading app, or a seamless video call—those were the markers of “experience,” right? Simple.

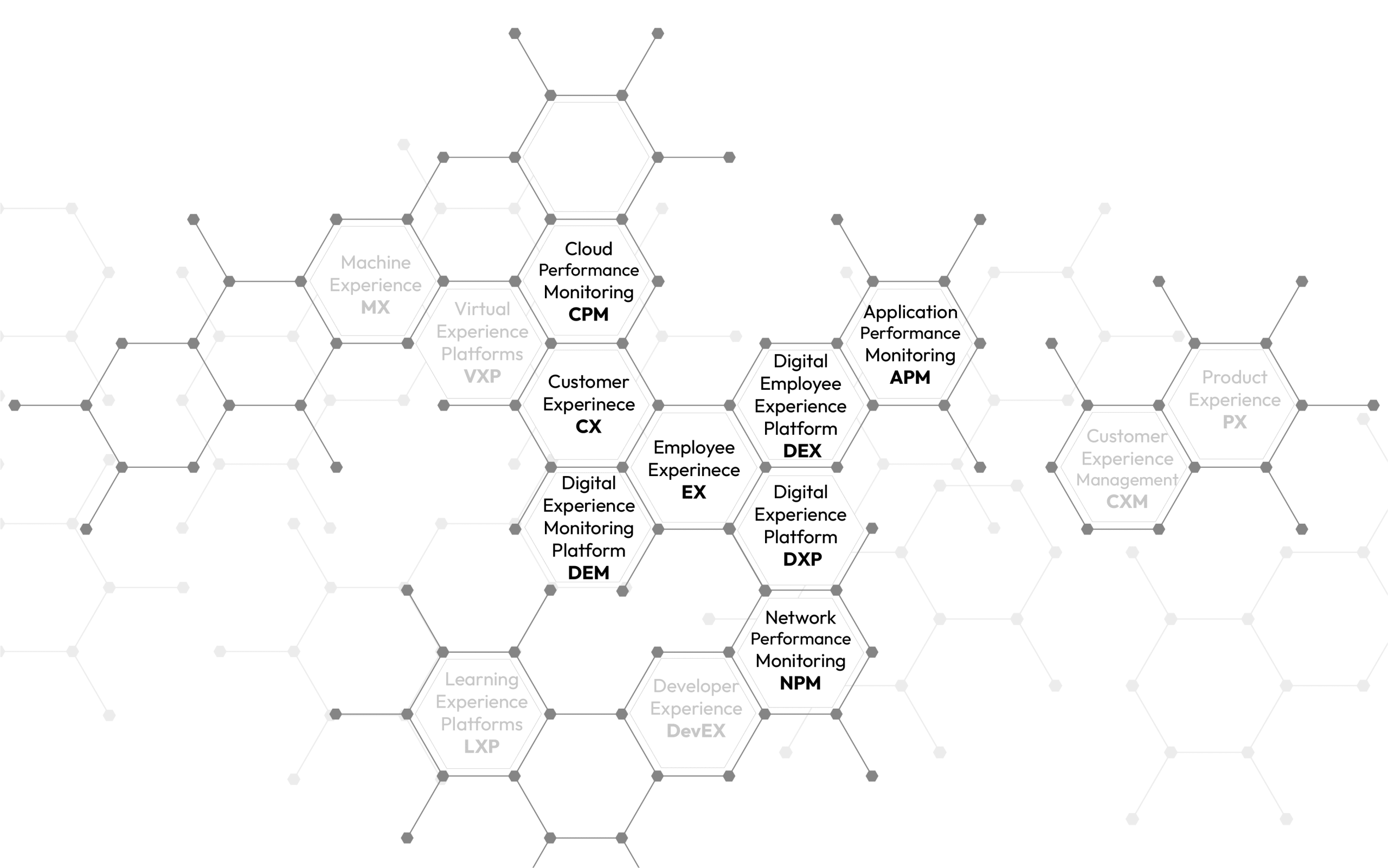

But then, something changed. Suddenly, “experience” became a buzzword that exploded across the industry. Everywhere I turned, I saw terms like Customer Experience (CX), Employee Experience (EX), Digital Experience Platforms (DXPs), Digital Employee Experience (DEX), Application Experience, Network Experience, Total Experience (TX), and more. It felt like every technology company had rebranded itself as a seller of “experience.” The more I heard, the more confused I became.

How could one word mean so many different things?

As I dug deeper, I realized the experience industry had become incredibly diverse and fragmented. Every company seemed to have its own definition, approach, and metrics for measuring experience. This complexity made understanding the market not just difficult but overwhelming.

To make sense of it all, I needed to take a step back. A simpler, clearer way to classify and group these “experience” players in a meaningful manner was essential

The Complexity of Experience Segments

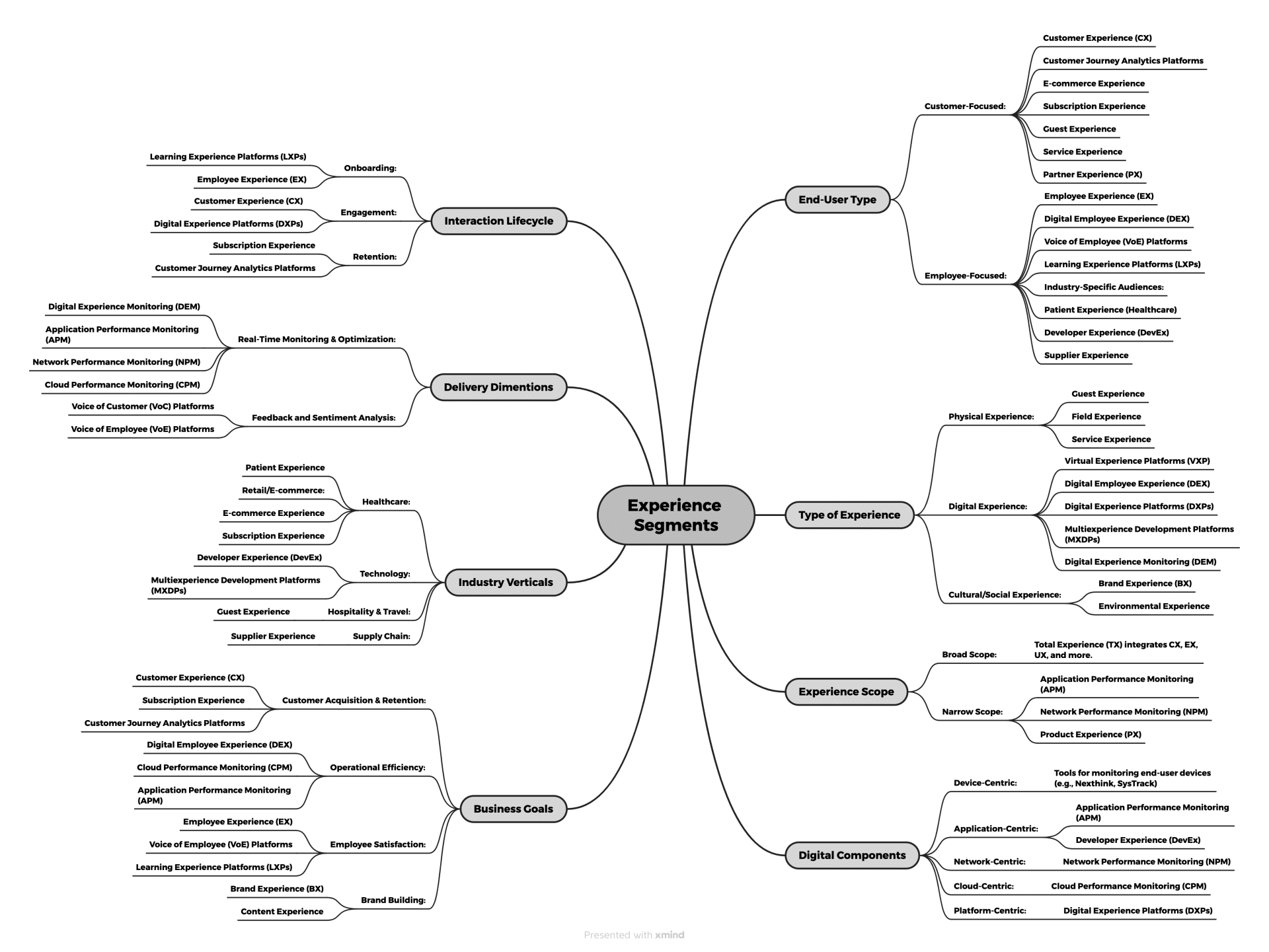

The experience industry isn’t just broad—it’s deeply fragmented. Companies align themselves with various “experience” labels, creating significant overlap and confusion. To make sense of it, I found that companies could be classified using different frameworks depending on the lens applied:

Experience Segments Classified

| Based on End-User Type | Customer-Focused: CX, E-commerce Experience, Subscription Experience. Employee-Focused: EX, DEX, Learning Experience Platforms (LXPs). Industry-Specific: Patient Experience (Healthcare), Developer Experience (DevEx). |

| Based on Type of Experience | Digital: DXPs, DEM, Virtual Experience Platforms (VXP). Physical: Guest Experience, Service Experience. Cultural/Social: Brand Experience (BX), Environmental Experience. |

| Based on Digital Components | Application-Centric: APM, DevEx. Network-Centric: NPM. Cloud-Centric: CPM. Device-Centric: DEX. |

| Based on Business Goals | Customer Acquisition & Retention: CX, Subscription Experience. Operational Efficiency: DEX, CPM. Employee Satisfaction: EX, VoE, LXPs. Brand Building: BX, Content Experience. |

| Based on Interaction Lifecycle | Onboarding: LXPs, EX. Engagement: CX, DXPs. Retention: Customer Journey Analytics. |

| Based on Emerging Trends | AI-Augmented Experiences: TX with AI-driven insights. Sustainability-Oriented Experiences: Environmental Experience |

| and more… |

Why this Matters?

- Identify Opportunities: Recognize which segments align with their goals.

- Streamline Investments: Avoid wasting resources on redundant tools or misaligned strategies.

- Enhance Focus: Deliver experiences that genuinely impact end-users.

A Retrospection: Why Experience?

The Two Core Categories of Experience Players

Delivering Experience Players

Managing Experience Players

Mapping the Experience Ecosystem

| Segment | Group | Example | Market Leader | |

| 1 | Customer Experience (CX) | Delivering Experience | Salesforce, Zendesk, HubSpot, Freshdesk, Oracle CX | Salesforce |

| 2 | Employee Experience (EX) | Delivering Experience | Qualtrics, Workday, SAP SuccessFactors, BambooHR | Qualtrics |

| 3 | Digital Experience Platforms (DXPs) | Delivering Experience | Adobe Experience Cloud, Sitecore, Acquia, Optimizely | Adobe |

| 4 | Application Performance Monitoring (APM) | Manage Experience | Dynatrace, New Relic, AppDynamics, Splunk, Instana | Dynatrace |

| 5 | Network Performance Monitoring (NPM) | Manage Experience | ThousandEyes, SolarWinds, LiveAction, Kentik, LogicMonitor | ThousandEyes |

| 6 | Digital Employee Experience (DEX) | Manage Experience | Nexthink, SysTrack, Lakeside, 1E, HappySignals |

Nexthink |